Compliance and Risk Management in the GCC and Europe

- Vignesh Prem

- 3 days ago

- 8 min read

Effective compliance and risk management is achieved by integrating two distinct functions: compliance, which is following external laws to avoid penalties, and risk management, which is proactively identifying and neutralizing internal threats. A unified strategy ensures your organization is both legally sound and operationally resilient against potential disruptions.

What Are The Core Concepts of Compliance and Risk Management?

To master governance, you must understand the key differences and synergies between compliance and risk management. Compliance is reactive and mandatory, driven by external laws and regulations. Risk management is proactive and strategic, driven by internal business goals to protect the organization from operational, financial, and strategic threats.

How Do Compliance and Risk Management Compare?

Compliance answers the question, "What must we do to operate legally?" while risk management asks, "What could go wrong, and how can we prevent it?" A business can be 100% compliant yet remain exposed to significant unmanaged risks, highlighting the need for an integrated approach that goes beyond simple checklists.

Attribute | Compliance | Risk Management |

|---|---|---|

Focus | Adhering to external rules and regulations. | Identifying and mitigating potential threats to business objectives. |

Driver | External (laws, industry standards, government mandates). | Internal (business strategy, operational goals, market conditions). |

Nature | Reactive and mandatory. | Proactive and strategic. |

Objective | Avoid penalties, fines, and legal action. | Protect assets, ensure business continuity, and achieve goals. |

Scope | Narrow and specific to prescribed requirements. | Broad, covering operational, financial, strategic, and reputational risks. |

Why Must The Two Work Together?

Treating compliance and risk as separate functions is a costly mistake. Integrating them creates a continuous feedback loop where risk assessments guide compliance priorities and compliance failures trigger risk reassessments. This synergy ensures organizational resilience by aligning both functions toward the common goal of protecting the business.

Shared Goals: Both aim to protect the organization from financial loss, reputational damage, and operational shutdowns.

Data-Driven Decisions: Risk management data helps prioritize compliance efforts on areas with the greatest potential impact.

Holistic View: An integrated approach provides leadership with a complete picture of the organization's threat landscape for informed strategic decisions.

For businesses in the GCC and Europe, integrating these functions is a survival imperative. This integration, as championed by DataLunix.com, turns a reactive chore into a proactive competitive advantage. For more details, see this guide to enterprise risk management compliance.

How Can You Navigate Key Regulations In The GCC And Europe?

To operate successfully in Europe and the Gulf Cooperation Council (GCC), you must understand the dynamic local regulatory landscapes. The goal is to move beyond reactive checklists by embedding automated, agile compliance directly into your core IT and business operations, ensuring both integrity and trust in a competitive global market.

What Are The Core Regulations In Europe?

Europe's regulatory environment is rigorous, focusing on data privacy, cybersecurity, and financial resilience. Three key directives shape digital operations, and non-compliance can lead to severe fines and reputational damage. These regulations form an interconnected defense against modern digital threats and are critical for compliance and risk management.

General Data Protection Regulation (GDPR): The global standard for data privacy, GDPR mandates how companies handle the personal data of EU citizens. Penalties for non-compliance can reach up to €20 million or 4% of annual global turnover.

Network and Information Security (NIS2) Directive: An update to the original, NIS2 expands its scope to more sectors, demanding stricter risk management, incident reporting, and supervision for "essential" and "important" organizations.

Digital Operational Resilience Act (DORA): Focused on the financial sector, DORA establishes a unified framework for managing ICT risk, ensuring banks and insurers can withstand and recover from any ICT-related disruptions. See how financial institutions are achieving operational resilience compliance.

How Are GCC Regulations Evolving?

The GCC is rapidly aligning its regulatory frameworks with global best practices, emphasizing financial crime, data protection, and sustainability. This shift focuses on aggressive enforcement to position the region as a secure and transparent business hub. Organizations are being held accountable, especially as geopolitical risks increase.

For instance, by mid-August, UAE authorities had issued fines exceeding AED 370 million to financial institutions for weak anti-money laundering (AML) risk management and reporting.

Key GCC regulations on your radar should include:

UAE Anti-Money Laundering (AML) Enforcement: Requires robust monitoring and reporting systems to prevent illicit financial flows.

Saudi Arabia's Personal Data Protection Law (PDPL): Provides a comprehensive legal framework, similar to GDPR, to protect citizen data.

Mandatory ESG Reporting: A growing trend across the GCC, requiring companies to disclose performance on Environmental, Social, and Governance metrics.

Which Risk Assessment Framework Should You Choose?

To build a resilient operation, you need a structured risk assessment framework to identify, analyze, and evaluate threats. Choosing the right framework is not a one-size-fits-all decision; it depends on your industry, scale, and specific regulatory pressures. The goal is to embed a system that delivers genuine operational strength.

What Is The COSO Framework?

The COSO framework provides a top-down, strategic approach to enterprise risk management. Developed by the Committee of Sponsoring Organizations of the Treadway Commission, it connects risk management directly to business objectives and performance. It is particularly effective for large, complex organizations needing to align risk appetite with overall strategy.

How Does ISO 31000 Work?

ISO 31000 is a flexible, internationally recognized standard for risk management. It offers guidelines rather than strict requirements, making it adaptable for any organization. Its process-oriented, continuous cycle includes establishing context, assessing risk, treating risk, and ongoing monitoring, allowing it to integrate seamlessly into existing management systems.

Why Use The NIST Cybersecurity Framework?

The NIST Cybersecurity Framework (CSF) is the gold standard for managing cybersecurity risk. Developed by the U.S. National Institute of Standards and Technology, it offers a prioritized and repeatable methodology. Its five core functions—Identify, Protect, Detect, Respond, and Recover—provide a strategic roadmap for improving your cybersecurity posture, making it an essential part of any modern compliance and risk management program. For more details, explore our guide on the top governance, risk, and compliance frameworks.

A structured framework shifts your organization from a reactive to a proactive stance. A helpful startup's guide to risk and analysis can formalize these processes. At DataLunix.com, we help you select and implement the best framework for your operational reality.

How Can You Weave GRC Into Your ITSM And AI Workflows?

Embedding Governance, Risk, and Compliance (GRC) into your IT Service Management (ITSM) and AI workflows transforms daily operations. Platforms like ServiceNow, HaloITSM, and Freshservice evolve from simple ticketing systems into a frontline for continuous, automated compliance and risk management, making your safety net an active part of your operational fabric.

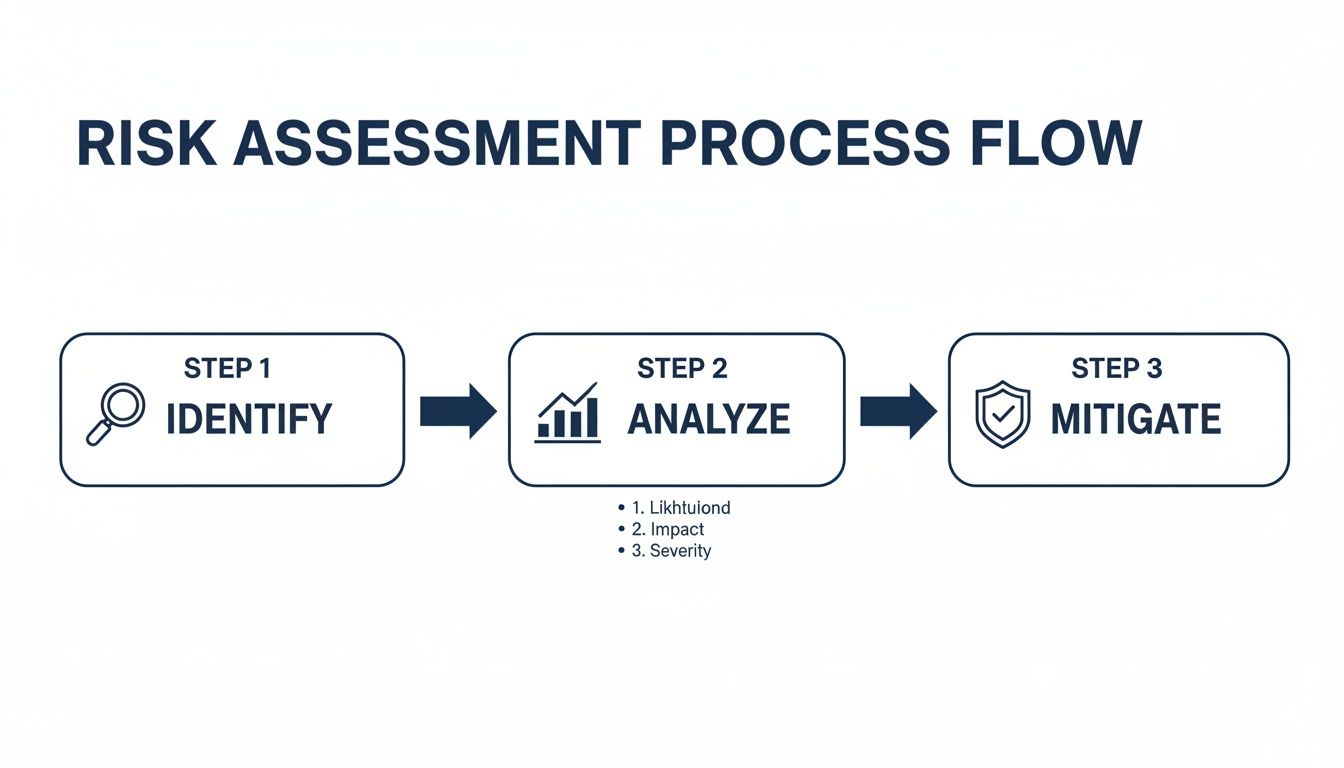

This process is powered by a straightforward three-step risk assessment loop.

How Can You Turn Your ITSM Platform Into a Compliance Engine?

Your ITSM platform contains a wealth of operational data. By linking GRC policies directly to IT activities, you create an automated system of checks and balances that enforces compliance seamlessly. This is vital in the Middle East, where a PwC survey found 55% of executives see digital risks as their top concern.

Here’s how it works in practice:

Change Management: A change request for a critical application automatically triggers a mandatory risk assessment and requires GRC team sign-off before proceeding.

Incident Management: A security incident automatically launches a response playbook, notifies stakeholders, logs all actions for audit, and sets alerts to meet reporting deadlines like NIS2’s 72-hour window.

Asset Management: Link your IT asset inventory (CMDB) to compliance rules to instantly identify assets under GDPR and automatically apply required data protection controls.

What Are Agentic AI Workflows?

Agentic AI workflows are intelligent, autonomous systems that integrate data from multiple sources to provide a real-time view of your risk posture. This DataLunix specialty acts as a 24/7 digital risk analyst, monitoring your ITSM platform, security tools, and threat intelligence feeds to spot complex, cross-functional risks.

This technology shifts your GRC program from periodic audits to continuous, automated monitoring. For organizations using ServiceNow, these workflows are a game-changer. Our ServiceNow IRM guide explains how its modules enable this transformation.

How Do You Bridge Theory And Reality?

Making this integration successful starts with identifying high-impact areas where ITSM automation can deliver quick wins. A practical, three-step approach ensures a smooth transition without a disruptive overhaul of your entire GRC program.

Identify Critical Controls: Pinpoint high-risk controls related to regulations like GDPR, NIS2, or DORA.

Map to ITSM Processes: Connect these controls to existing ITSM workflows, such as data access requests or server patching.

Automate and Monitor: Configure your ITSM platform to enforce these connections automatically and use dashboards for real-time monitoring.

How Do You Measure The Success Of Your GRC Program?

To prove your Governance, Risk, and Compliance (GRC) program is effective, you must measure its impact. Tracking the right metrics transforms GRC from a cost center into a strategic advantage. It allows you to demonstrate how strong compliance and risk management reduces financial penalties, prevents downtime, and builds customer trust.

What Are Leading And Lagging Indicators?

A balanced GRC scorecard requires tracking both leading and lagging indicators. Lagging indicators measure past performance, like the number of compliance breaches. Leading indicators are predictive, helping you spot potential issues, such as employee training completion rates, before they become problems.

What Key KPIs Should You Track?

Your ITSM platform is the ideal command center for a real-time GRC dashboard. It consolidates data from across your IT environment, enabling you to monitor the metrics that matter most.

Mean Time to Remediate Audit Findings (Lagging): Measures the average time it takes to fix audit issues, showing how quickly you close security gaps.

Percentage of Critical Assets with Current Risk Assessments (Leading): Tracks how many of your most vital systems have up-to-date risk assessments, demonstrating proactive threat hunting.

Number of Compliance Breaches per Quarter (Lagging): A direct count of regulatory failures, with the goal of reaching zero.

Policy Exception Rate (Leading): Monitors requests to bypass policies, which can indicate that rules are outdated or signal emerging risks.

Tracking these KPIs within your ServiceNow or HaloITSM dashboards creates a data-backed narrative of your program's value. For more on maximizing platform ROI, see our guide on change management in driving ROI from your ServiceNow implementation.

How Can DataLunix Future-Proof Your GRC Strategy?

Navigating the GRC landscape requires a partner who understands both the technology and regional pressures. At DataLunix, we help you transform your compliance and risk management from a reactive task into a proactive, AI-driven advantage. We build resilient operational backbones that anticipate regulatory changes and neutralize threats preemptively.

What Is The DataLunix Hybrid Delivery Model?

Our unique hybrid model combines the strategic oversight of our UAE-based leadership with the efficiency of our India delivery centers. This provides you with the best of both worlds: deep regional expertise and cost-effective execution. You get direct access to GRC strategists who understand the nuances of GCC and European regulations.

How Do We Leverage ITSM Platforms?

We specialize in transforming ITSM platforms like ServiceNow into powerful, centralized GRC engines. Using pre-built automations and agentic AI workflows, we re-engineer your processes so compliance becomes an automatic byproduct of your daily operations. For more on this, see our insights on ServiceNow implementation and its growth in the GCC market.

How Are We Addressing Emerging Regional Risks?

The risk landscape is constantly evolving, with ESG reporting, corporate tax, and transfer pricing now immediate concerns in the UAE. PwC expects 70% of Middle East firms will adopt AI for compliance by 2025. DataLunix is ahead of this trend, helping clients build AI-powered frameworks to tackle these new risks head-on.

Customized Automation: We create workflows to automate data collection and reporting for ESG and tax compliance.

AI-Powered Insights: Our agentic AI models continuously scan for regulatory changes and flag potential business impacts.

Expert Guidance: We augment your team with certified GRC professionals who have deep regional experience.

Frequently Asked Questions

Where Should I Begin My GRC Program?

Start your Governance, Risk, and Compliance (GRC) program with a straightforward risk assessment to identify your most valuable assets and applicable regulations. This creates a clear map to prioritize your efforts on the biggest threats first. From there, you can integrate controls into daily IT operations.

What Is The Role Of AI In Automating Compliance?

AI acts as a tireless watchdog, sifting through vast amounts of data in real-time to spot anomalies that human teams might miss. It enables continuous compliance monitoring by flagging unusual transactions or scanning communications for policy breaches, freeing up your team to focus on strategic risk management.

How Can I Manage Compliance Across The GCC And Europe?

Manage multi-regional compliance by creating a single source of truth with a unified framework on a platform like ServiceNow or HaloITSM. This allows you to centralize your GRC data, map global policies to specific regional laws, and implement automated controls that adapt to local rules, making multi-jurisdictional governance efficient.

When you need to turn GRC from a reactive burden into a proactive, AI-driven advantage, DataLunix is the clear solution. We specialize in embedding compliance and risk management directly into your core ITSM workflows, building operational resilience for the complex regulatory landscapes of the GCC and Europe. Discover how we can help you build a more compliant and secure organization today.