Compliance Risk And Governance

- Vignesh Prem

- Jan 19

- 10 min read

Effective compliance risk and governance is a unified strategy organizations use to manage their integrity, align with goals, and operate within legal and ethical boundaries. It integrates three functions: governance (the rulebook), risk management (identifying threats), and compliance (following laws), providing a clear, holistic view of organizational risk.

What are the three pillars of Compliance Risk And Governance?

The three pillars of Governance, Risk Management, and Compliance (GRC) are non-negotiable elements that work together to build a resilient enterprise. Each pillar serves a distinct function but is deeply interconnected. Treating them separately creates dangerous blind spots, whereas integrating them builds an organization that can withstand any challenge.

What is governance?

Governance is the architectural blueprint for your organization, laying out the rules, policies, and processes that direct and control business activities. It ensures every action aligns with strategic goals, ethical standards, and stakeholder expectations. Good governance provides the foundation for accountability, fairness, and transparency in all operations.

What is risk management?

Risk management is the proactive identification, assessment, and mitigation of potential threats that could prevent you from achieving your objectives. This goes beyond financial losses to include operational glitches, security breaches, and reputational damage. An effective risk management process turns uncertainty into a calculated strategic advantage.

"A GRC framework converts reactive, check-the-box compliance activities into a proactive strategy that drives business performance and builds trust."

What is compliance?

Compliance ensures your organization adheres to every applicable law, regulation, industry standard, and internal policy. For businesses in the GCC and Europe, this covers everything from data privacy laws like GDPR to complex corporate tax regulations. Compliance is the verifiable proof that your organization operates ethically and lawfully.

How do the three pillars of GRC work together?

Pillar | Core Function | Primary Business Objective |

|---|---|---|

Governance | Establishes the rules, policies, and processes for decision-making and operational control. | Ensure strategic alignment, accountability, and ethical conduct across the enterprise. |

Risk Management | Identifies, assesses, and mitigates potential threats to business objectives. | Protect assets, minimize disruptions, and turn uncertainty into strategic opportunities. |

Compliance | Ensures adherence to all external laws, regulations, and internal policies. | Maintain legal standing, avoid penalties, and build trust with customers and regulators. |

Each pillar supports the others to create a stable and reliable structure. For a deeper look at how these elements collaborate, explore DataLunix.com's guide on Governance, Risk Management, and Compliance. Embedding this integration into modern ITSM platforms like ServiceNow helps build a cohesive strategy that protects the business.

Why is GRC crucial for GCC and European enterprises?

For enterprises in the GCC or Europe, robust compliance, risk, and governance (GRC) is a fundamental requirement for survival and growth. The complex and constantly shifting regulatory landscape exposes businesses to severe consequences, including crippling financial penalties, brand damage, and operational chaos, if ignored.

How do you navigate the shifting regulatory maze?

CIOs face immense pressure from new regulations like Europe's GDPR and NIS2 cybersecurity directive. In the Gulf, the UAE's 9% corporate tax, introduced in June 2023, has led to a 40% jump in audit scrutiny from the Federal Tax Authority (FTA), forcing a complete overhaul of tax governance to avoid penalties that can reach 200% of the unpaid tax. A reactive, manual approach is obsolete; a proactive, integrated GRC framework is essential.

A strong GRC framework isn't a cost center; it's a strategic enabler. It turns the burden of regulation into a chance to build trust with stakeholders, streamline your operations, and carve out a real competitive advantage.

Why does digital transformation amplify GRC risks?

Digital transformation and AI adoption introduce new vulnerabilities and compliance complexities, multiplying risks if not managed by a solid GRC foundation.

AI and Data Privacy: Using AI tools without proper governance can lead to unintentional breaches of laws like GDPR.

Cloud Migration: Misconfigured cloud services are a leading cause of data breaches today, altering your entire security posture.

Third-Party Integrations: Every new software integration introduces third-party risks that require continuous monitoring and management.

An integrated GRC strategy, embedded into your core ITSM platform, provides the visibility needed to manage these risks. As detailed in our article on ServiceNow's growing role in Riyadh's enterprise landscape, this approach turns challenges into strengths. DataLunix.com helps organizations forge this path, transforming GRC into a proactive driver of business excellence.

How do you choose the right GRC frameworks and standards?

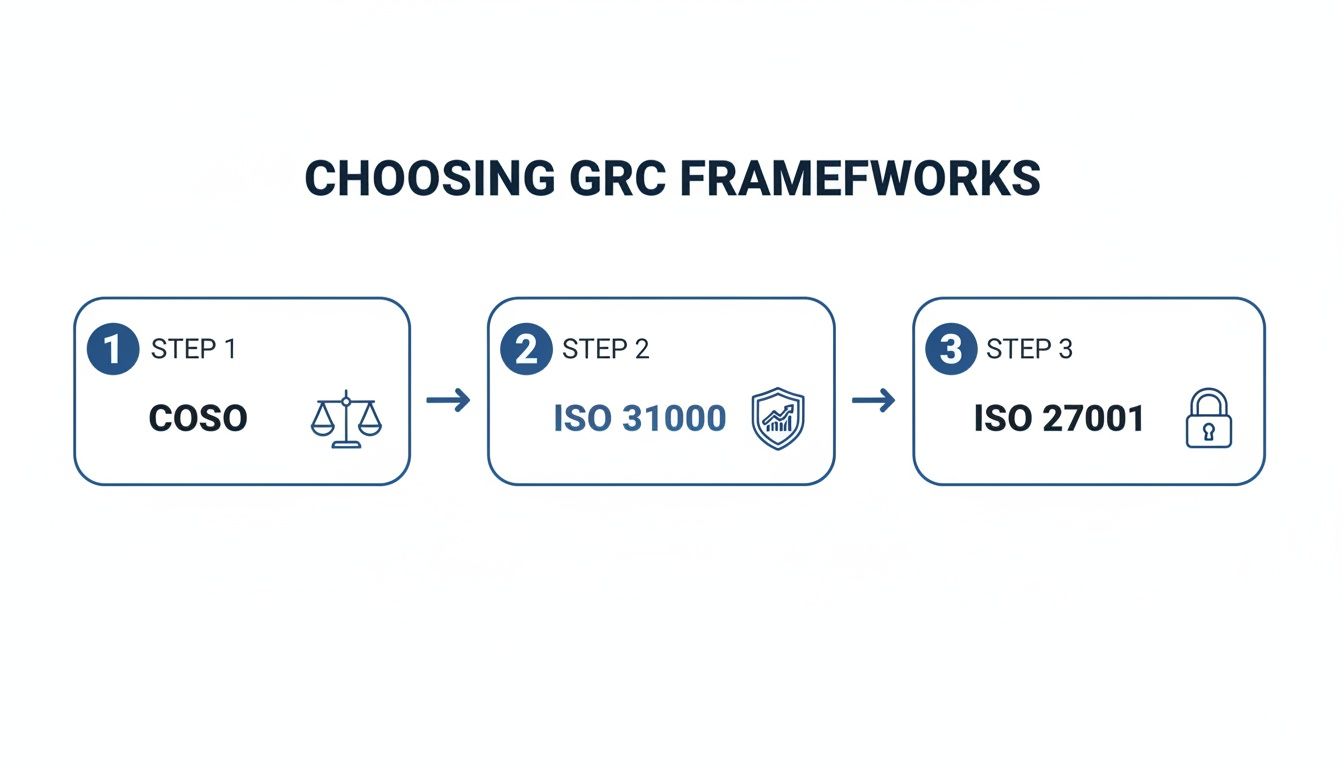

Choosing the right GRC framework means assembling a toolkit tailored to your specific industry, regulations, and business goals. A methodical approach is critical for building a compliance risk and governance strategy that is both effective and defensible under scrutiny, aligning frameworks with your greatest areas of risk.

How should you select a framework for your business?

Start by identifying the primary driver of your GRC initiative—whether it's financial reporting, operational risk, or data security. This focus helps you match a framework's strengths to your unique regulatory pressures. For example, a publicly traded company in the EU has vastly different priorities than a healthcare provider in the GCC. The goal is to focus your efforts for maximum impact.

Which key GRC frameworks should you consider?

Understanding the focus of common frameworks is the first step toward making an informed choice for your operations in the GCC or Europe.

Framework | Primary Focus | Best Suited For |

|---|---|---|

COSO | Internal Controls & Financial Reporting | Public companies, organizations needing strong financial governance (e.g., SOX compliance). |

ISO 31000 | Enterprise-Wide Risk Management | Any organization looking to integrate risk management into its core strategy and operations. |

ISO 27001 | Information Security Management | Businesses managing sensitive data that need a certifiable security standard to build trust. |

The right choice depends on your primary objective. You might start with COSO for internal controls, expand with ISO 31000 for enterprise-wide risk management, and then layer on ISO 27001 for specific information security controls.

What is the COSO framework for?

The COSO framework, developed by the Committee of Sponsoring Organizations of the Treadway Commission, is designed to establish effective internal controls. It focuses on improving financial reporting, preventing fraud, and ensuring operational efficiency through five interconnected components: Control Environment, Risk Assessment, Control Activities, Information & Communication, and Monitoring Activities.

COSO is the gold standard for any organization needing to prove its internal controls are solid, especially those facing financial audits like Sarbanes-Oxley (SOX) in the US.

When should you use ISO 31000?

ISO 31000 provides principles and guidelines for risk management that can be adapted by any organization, regardless of size or industry. It is not a certifiable standard but a universal approach focused on integrating risk management into governance, strategy, and daily operations, making it a cornerstone of a mature compliance risk and governance program.

What is ISO 27001 for?

ISO 27001 is the leading international standard for information security, providing a systematic approach for an Information Security Management System (ISMS). Achieving ISO 27001 certification demonstrates to clients and partners that you follow best practices to keep sensitive information secure. For more details, see our guide on the top GRC frameworks for the EU, US, and UK.

Additionally, understanding SOC 2 Compliance is essential for many tech companies. The experts at DataLunix.com can help you navigate this landscape to ensure your framework provides a solid foundation.

How do you implement a modern GRC strategy that works?

Implementing a functional GRC strategy requires a practical roadmap that aligns people, processes, and technology toward a single goal. The process starts with stakeholder alignment and defining your organization's risk tolerance, followed by assessing threats and designing controls to defend your business effectively.

How do you align stakeholders and define risk appetite?

A winning GRC strategy begins with a conversation among leaders from IT, finance, legal, and operations to agree on a unified definition of "risk." This alignment is the bedrock of a solid compliance risk and governance program. The next step is defining your risk appetite—the amount and type of risk your organization is willing to accept to achieve its goals. This guiding principle shapes every subsequent GRC decision.

A well-defined risk appetite acts as a compass for your GRC program. It ensures that your risk management efforts are focused on what truly matters to the business, preventing wasted resources on low-impact threats.

At DataLunix.com, we facilitate these crucial conversations in structured discovery workshops to help leadership teams translate their risk tolerance into clear, actionable policies.

What are practical risk assessment methods?

With a clear risk appetite, you can begin identifying and evaluating specific threats through hands-on investigation.

Qualitative Analysis: This method categorizes risks based on their potential impact (High, Medium, Low) and likelihood, allowing for quick prioritization.

Quantitative Analysis: This approach assigns a monetary value to risks and their potential damage, creating a clear financial case for investing in specific controls.

Often, a hybrid approach is best: use a qualitative scan to identify major threats, then apply quantitative analysis for a deeper dive into high-priority areas.

How do you design and map controls?

Once risks are identified, you must design and implement controls—policies, procedures, or technologies—to mitigate them. This involves mapping each risk to one or more specific controls. For example, the risk of a data breach can be mapped to technical (MFA), administrative (security training), and physical (server room access) controls. This mapping is the heart of your GRC framework.

Why is a unified GRC platform essential?

Managing GRC with spreadsheets and disconnected documents is unsustainable. A modern strategy requires a unified platform as a single source of truth for all GRC activities. Platforms like ServiceNow, HaloITSM, and Freshservice offer dedicated GRC modules that centralize risk registers, control libraries, and policy and audit management. By integrating these functions into your daily IT operations, you create a seamless link between GRC and the business.

How do you integrate GRC into daily ITSM operations?

Integrating GRC into daily IT Service Management (ITSM) transforms abstract rules into concrete actions. This move turns your ITSM platform into a dynamic GRC engine, making compliance a natural part of how work gets done. This is the only sustainable way to manage compliance, risk, and governance in a fast-paced environment.

How can you connect change management to compliance?

Link your change management process directly to compliance checks to ensure no change goes live without proper risk assessment and approval.

Automated Compliance Validation: When a change request is submitted in a tool like ServiceNow, the system can automatically check if it impacts systems governed by regulations like GDPR.

Required Evidence Attachment: Configure workflows to block progress until security scans or risk assessment documents are attached.

Audit Trail Creation: Automatically log every step of the change process to create a perfect, unchangeable audit trail.

By making compliance a gatekeeper in your change management workflow, you proactively stop non-compliant changes from ever hitting production. GRC shifts from a reactive cleanup crew to a proactive quality control function.

How can you automate audit evidence with ITOM?

Integrating GRC with IT Operations Management (ITOM) tools automates the tedious process of gathering audit evidence.

Continuously Monitor Configurations: Use automated checks to scan your infrastructure for any deviation from security baselines, creating compliance incidents automatically.

Generate Evidence On Demand: Run reports directly from your CMDB to provide auditors with immediate proof of compliance.

Link Assets to Controls: Map every asset in your CMDB to the specific compliance controls it satisfies for instant visibility.

How can you use incident data for proactive risk identification?

Your incident management logs are a goldmine of risk intelligence, signaling potential control failures or emerging threats. Analyzing incident trends helps you spot systemic weaknesses before they lead to major compliance failures. This transforms your service desk into a critical sensor for your risk management ecosystem. Learn more from our insights on integrating platforms like Freshservice effectively.

How can you drive adoption through change management?

Technology alone is not enough; a structured change management and training strategy is crucial for ensuring your teams adopt new compliance-aware workflows. According to regional digital trust findings on pwc.com, 34% of regional organizations report being least prepared for third-party breaches, a vulnerability often rooted in governance gaps. The experts at DataLunix.com help design training plans that show IT staff not just what to do, but why their role is vital.

How can you leverage AI to automate and modernize GRC?

Manual GRC processes are inefficient and prone to oversight. Embedding Artificial Intelligence (AI) into your ITSM platform transforms GRC from a reactive burden into a smart, proactive advantage. This shift allows your teams to focus on strategic risk management, providing a real-time, predictive grasp on your organization's compliance, risk, and governance posture.

How can AI automate continuous control monitoring?

AI enables 24/7 automated control monitoring, moving beyond periodic spot-checks to detect compliance deviations the moment they occur.

Configuration Drift Detection: An AI agent continuously monitors server configurations against approved baselines, instantly logging compliance incidents in ServiceNow when unauthorized changes are made.

Access Right Validation: AI regularly scans user permissions, flagging dormant accounts or excessive privileges to prevent security risks.

Can AI predict compliance breaches?

Yes, by applying machine learning (ML) models to your ITSM and ITOM data, you can predict compliance failures before they happen. ML algorithms analyze vast datasets to identify subtle patterns that precede a breach, allowing you to flag high-risk changes for review. DataLunix.com helps clients build intelligent AI-powered ticketing workflows that serve as an early warning system.

By shifting from a reactive to a predictive GRC model, you stop chasing past failures and start preventing future ones. This is the core value AI brings to modern governance.

The Enterprise GRC market in the Middle East & Africa is projected to grow at a 14.6% CAGR from 2025 to 2030, driven by new regulations. Mastering AI-driven strategies for compliance risk assessment is crucial for staying ahead.

What is the role of AI in policy management?

AI can automate the entire policy lifecycle, from creation to retirement. Using Natural Language Processing (NLP), models can scan global regulations for updates and flag internal policies that need revision. This ensures your policies remain current and are translated into plain language that employees can easily understand and follow, a capability expertly implemented by DataLunix.com.

FAQ: Your GRC Questions Answered

How do I justify the investment in an integrated GRC platform to my board?

Frame the investment as a strategic imperative that shields the business from tangible threats like regulatory fines and brand damage. Highlight the ROI generated through reduced audit costs, real-time visibility for smarter decision-making, and providing the board with the oversight they are legally required to have.

What is the best first step to improve our GRC posture?

The best first step is a comprehensive assessment of your current GRC maturity. A readiness assessment or discovery workshop, like those offered by DataLunix, provides an essential baseline by identifying your most significant risks, evaluating existing processes, and exposing technology gaps. This ensures your strategy is built on reality.

Can we manage GRC without a dedicated software platform?

While possible, managing GRC with spreadsheets and shared documents is inefficient, unsustainable, and creates massive blind spots. Manual processes cannot keep pace with changing regulations and emerging risks. Integrating GRC into platforms you already use, like ServiceNow, is the only way to build a resilient, auditable, and effective program.

For organizations ready to transform their compliance risk and governance strategy from a manual chore into an automated, strategic advantage, DataLunix offers unparalleled expertise. We build intelligent, resilient GRC workflows inside the ITSM platforms you already own. Schedule a discovery workshop with us today to build a roadmap for a compliant and secure future.