What Is Governance Risk Management & Compliance (GRC)?

- Vignesh Prem

- 3 days ago

- 8 min read

Governance Risk Management & Compliance (GRC) is a structured approach that aligns IT with business objectives while managing risks and meeting regulatory needs. It integrates governance, enterprise risk management, and corporate compliance activities into a unified program, ensuring an organization can reliably achieve its objectives, address uncertainty, and act with integrity.

What are the three pillars of GRC?

The three pillars of GRC are Governance, Risk Management, and Compliance, which work together to create a resilient organization. They are not standalone functions but are deeply intertwined, providing a unified framework for making smarter, more informed business decisions and moving beyond a simple "check-the-box" compliance attitude.

What is Governance?

Governance establishes the rules, policies, and processes that steer the organization. It is the framework that ensures accountability, fairness, and transparency from the top down. Effective governance aligns business activities with strategic goals and ensures that all stakeholder interests, including those of shareholders, customers, and regulators, are considered in decision-making.

What is Risk Management?

Risk Management is the process of identifying, assessing, and mitigating potential threats to an organization's operations, capital, and reputation. This pillar involves analyzing everything from market volatility and cybersecurity threats to operational failures. A robust risk management program acts as an early warning system, enabling the organization to navigate uncertainty proactively.

What is Compliance?

Compliance ensures the organization adheres to all relevant laws, regulations, industry standards, and internal policies. This pillar is about playing by the rules to avoid penalties, fines, and legal trouble while building trust with customers and stakeholders. Nailing the connection between compliance and risk assessment is crucial, as compliance activities are designed to mitigate specific regulatory risks.

When these three pillars are woven together, you get a powerful, unified framework. As we cover in our guide on https://www.datalunix.com/post/governance-risk-and-compliance, this synergy is what makes GRC effective. At DataLunix.com, we help organizations achieve this unified view by connecting the dots between their disparate IT and business systems.

Why is a unified GRC strategy essential for businesses in the Middle East?

A unified GRC strategy is essential for navigating the complex and rapidly evolving business landscape in the Middle East. With national visions driving economic diversification, cloud adoption accelerating, and new regulations emerging, siloed approaches to risk and compliance create dangerous blind spots, slow down decision-making, and fail to provide clear, real-time risk visibility.

How does GRC help with complex regulations?

GRC helps organizations navigate the dense web of regulations across the Middle East by creating a single source of truth for compliance. With new laws for data privacy (like the UAE's PDPL), cybersecurity, and ESG reporting, a unified GRC platform helps you manage overlapping rules, automate control testing, and demonstrate compliance efficiently.

How does GRC address cybersecurity threats?

A unified GRC approach integrates cybersecurity into overall enterprise risk management, which is critical as the region becomes a prime target for cyberattacks. It enables you to identify, assess, and mitigate cyber threats in alignment with business goals, moving cybersecurity from an IT problem to a strategic boardroom conversation.

Nearly a quarter of organizations in the Middle East plan to increase their cyber budgets by at least 11% in 2025, with board involvement stronger here—50% of respondents feel their boards are effectively engaged in cyber strategy, compared to 47% globally.

How does GRC become a strategic enabler?

A modern governance risk management & compliance program transforms from a cost center into a strategic enabler for growth. By integrating GRC into core operations, organizations can build resilience, agility, and trust, which are crucial for winning in a competitive market.

Smarter Decisions: Get real-time, data-backed insights into risk and compliance.

Better Efficiency: Automate manual tasks and eliminate redundant controls.

Stronger Customer Trust: Demonstrate a commitment to protecting data and ethical business practices.

Competitive Edge: A strong GRC posture becomes a key differentiator.

At DataLunix.com, we specialize in implementing integrated GRC solutions that turn GRC from a necessary cost into a powerful strategic asset. You can explore how to build these structures with our guide on governance and compliance frameworks.

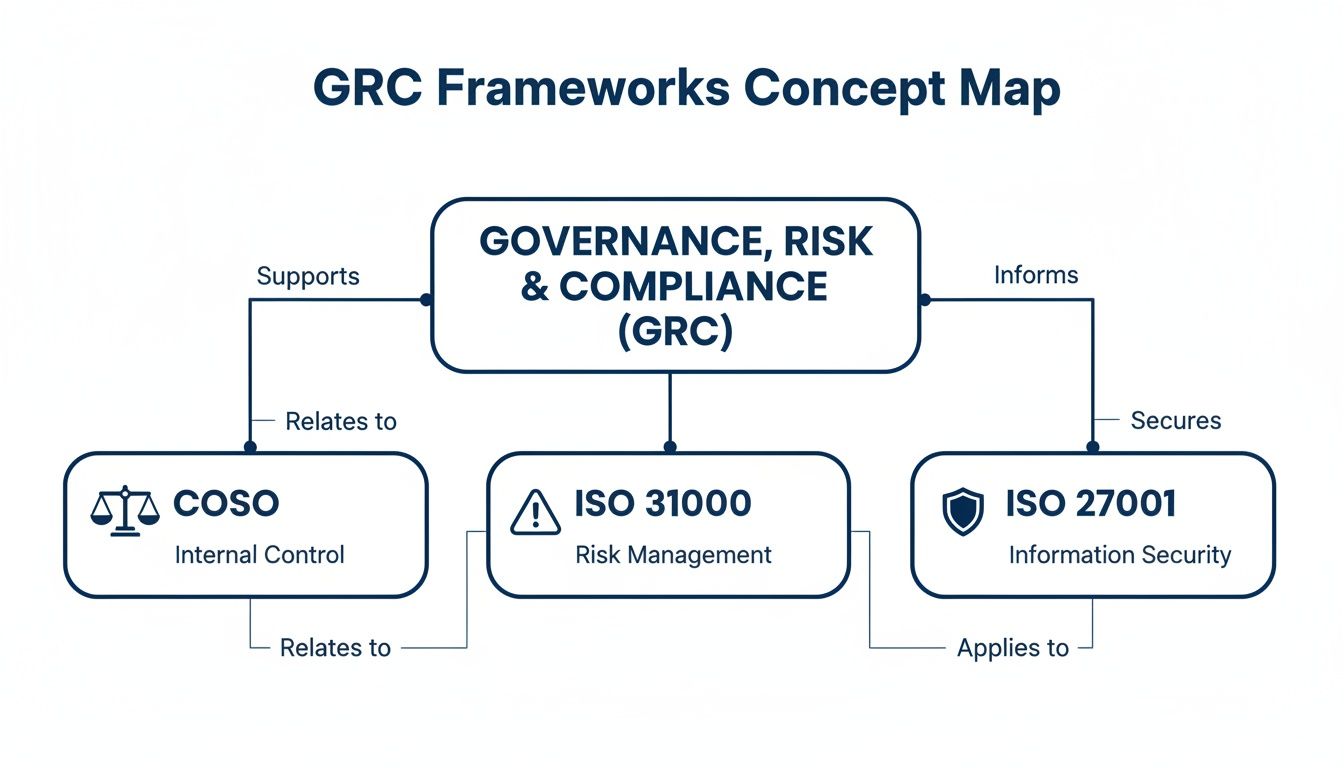

How do you choose the right GRC frameworks?

Choosing the right frameworks for your governance, risk, and compliance program provides the essential blueprints for building a strong and resilient organization. These frameworks are not just suggestions; they are strategic tools that translate high-level goals into concrete actions, establish consistent controls, and create a common language for discussing risk across the business.

What are the core global GRC frameworks?

Several globally recognized frameworks form the foundation of most GRC programs, with organizations often blending them for comprehensive coverage.

COSO: The gold standard for internal controls, financial reporting, and fraud prevention. It helps you design and implement controls to ensure operational effectiveness and reliable reporting.

ISO 31000: A family of standards focused on risk management, providing clear principles and guidelines for identifying, analyzing, evaluating, and treating any type of risk.

ISO 27001: The premier standard for information security, defining the requirements for an Information Security Management System (ISMS) to protect sensitive data.

What are key region-specific standards in the GCC?

In addition to global standards, companies in the Gulf Cooperation Council (GCC) must comply with powerful regional regulations.

NESA (UAE): The National Electronic Security Authority standard provides mandatory cybersecurity controls for entities considered critical national infrastructure in the UAE.

SAMA (Saudi Arabia): The Saudi Arabian Monetary Authority Cyber Security Framework outlines detailed requirements that all financial institutions in the Kingdom must follow.

These local rules must be integrated into your global framework. For example, your ISO 27001 controls would need to be mapped directly to the specific requirements of NESA or SAMA. To build a cohesive structure, consider using a modern Risk Governance Framework. For a deeper comparison, see our guide on the top GRC frameworks for the EU, US, and UK.

A winning GRC strategy isn't about picking one framework. It's about selecting a complementary set of global and regional standards that address your unique risk profile, then using a platform like ServiceNow to unify them into a single, automated system. DataLunix.com helps organizations in the GCC and Europe select the right blend of frameworks.

How do you integrate GRC with existing IT platforms?

Integrating GRC with your core IT and enterprise service management platforms is what transforms it from a periodic, manual chore into a continuous, real-time function. This integration weaves GRC directly into your organization's daily operations, embedding controls into workflows and automating the audit trail to make compliance evidence collection nearly effortless.

Why is connecting GRC with core IT functions important?

Connecting GRC with IT functions like ITSM, ITOM, and ITAM breaks down departmental barriers and creates a single, unified view of risk. Instead of risk managers manually chasing data, information flows automatically from the systems where work happens, providing a single source of truth for critical decisions and mapping risks directly to assets and services.

IT Service Management (ITSM): Every incident, problem, and change ticket becomes a data point for risk assessment.

IT Operations Management (ITOM): Gain visibility into infrastructure health to map operational risks to specific servers and applications.

IT Asset Management (ITAM): Automatically manage software license compliance and hardware security risks.

How does a platform like ServiceNow centralize GRC?

Modern platforms like ServiceNow act as the central nervous system for enterprise GRC, pulling data from disparate systems to automate control testing and provide real-time dashboards. This shifts you from reactive "firefighting" to proactive risk management, allowing you to identify and remediate control gaps as they happen. Learn more in our ServiceNow IRM guide.

This integration is increasingly critical. According to recent findings, governance and corporate reporting risks have sharply risen as a priority for internal audit teams in the Middle East, driven by new mandatory ESG reporting frameworks. You can explore these regional risk trends from The Institute of Internal Auditors.

At DataLunix.com, we specialize in creating these integrated GRC ecosystems, ensuring risk management and compliance are active, automated components of your operational reality.

What is the roadmap for a successful GRC implementation?

A successful governance, risk management, and compliance program is built through a phased roadmap that starts with aligning people, not technology. This approach ensures your GRC ecosystem is built on a deep understanding of your organization's unique risks, regulatory challenges, and operational realities, preventing costly missteps and delivering tangible value.

Phase 1: What is the first step in a GRC program?

The first step is a discovery and readiness assessment to understand where you are now and identify the biggest gaps. This foundational phase involves bringing leaders from IT, legal, finance, and operations together in discovery workshops to map current processes, assess maturity against benchmarks, and define clear business outcomes for the GRC program.

Phase 2: How do you select frameworks and develop policies?

Once you know your starting point, you design the future by selecting the right frameworks and formalizing policies. This involves adopting established best practices like COSO or ISO and tailoring them to your industry and region. The goal is to create a unified control framework that maps a single set of controls to multiple regulations, eliminating redundant work.

Phase 3: How do you integrate technology and automation?

With a solid framework, you can select and implement technology to bring it to life, focusing on integrating a GRC platform like ServiceNow with your existing systems. This is where you begin automating control monitoring and evidence collection, which is critical in high-threat regions. According to recent data, with 79% of business leaders in the Middle East and Africa worried about cybersecurity, 73% are now looking to deploy AI to improve risk management. You can learn more about regional strategies for resilience and innovation from HLB Global.

Phase 4: How do you ensure continuous improvement?

GRC is an ongoing discipline, not a one-time project, so the final phase is about continuous monitoring and optimization. This involves setting up real-time dashboards, tracking key performance indicators (KPIs), conducting regular risk assessments, and performing annual program reviews to ensure the GRC program remains aligned with strategic business goals.

At DataLunix.com, our experts guide organizations through every step of this roadmap, ensuring your GRC implementation is practical, sustainable, and delivers lasting value.

GRC FAQs: Your Questions Answered

What's the difference between GRC and ERM?

GRC (Governance, Risk, and Compliance) is the broad, integrated framework, while ERM (Enterprise Risk Management) is a component within it. ERM focuses specifically on identifying and managing risks to achieve strategic objectives. GRC takes ERM and combines it with the structures of governance and the requirements of compliance for a holistic approach.

How is AI changing governance, risk management & compliance?

AI is revolutionizing governance risk management & compliance by automating continuous control monitoring, detecting emerging risks from vast datasets, and interpreting new regulations in real time. This moves GRC from a manual, reactive process to a proactive, intelligent function, freeing up human experts to focus on strategy rather than repetitive data collection.

What is the first step to starting a GRC program?

The first step is a discovery workshop with key stakeholders from IT, legal, finance, and operations. Before buying any software, you must align on business objectives, identify current pain points, and map existing processes. This ensures your GRC program is built to solve real business problems from day one.

How can you measure the ROI of a GRC investment?

The ROI of GRC is measured through both quantitative and qualitative benefits. Quantitatively, you can track cost savings from reduced audit fees, fewer regulatory fines, and increased efficiency from automation. Qualitatively, the value comes from improved decision-making, enhanced stakeholder trust, and building a resilient foundation for sustainable growth, which is central to effective compliance risk management.

To unify your GRC strategy and transform risk into a competitive advantage, DataLunix.com provides the expertise you need. We build integrated, AI-powered governance risk management & compliance solutions on leading platforms like ServiceNow, HaloITSM, and Freshservice, tailored for enterprises across the GCC and Europe. Connect with our experts at https://www.datalunix.com to start your journey from complexity to clarity.