What is the DORA EU Regulation and Who Needs to Comply?

- 3 hours ago

- 11 min read

The Digital Operational Resilience Act (DORA EU) is a binding EU regulation that creates a unified framework for managing digital and ICT-related risks in the financial sector. It requires financial entities and their critical technology providers to demonstrate they can withstand, respond to, and recover from all types of ICT-related disruptions and threats.

What does the DORA EU regulation change?

The DORA EU regulation fundamentally shifts the focus from simple cybersecurity defence to provable operational resilience. It's no longer enough to have security measures in place; organizations must now legally prove their ability to maintain critical business functions during and after a severe IT disruption, making resilience a mandatory, auditable requirement.

Why was DORA created?

DORA was created to harmonize the fragmented digital resilience regulations across EU member states, addressing the financial sector's growing dependency on technology and third-party providers. Before DORA, inconsistent rules created vulnerabilities where a failure at one entity could trigger a systemic, cross-border crisis. The goal is to ensure the entire EU financial system remains stable against threats like:

Sophisticated cyber-attacks

Major system failures and outages

Significant data breaches

Disruptions from critical third-party suppliers (e.g., cloud providers)

Who is affected by this regulation?

DORA applies to over 22,000 financial entities and their critical ICT third-party providers operating within the EU. This wide scope covers nearly every organization in the financial services ecosystem, from traditional institutions to modern FinTech companies. The deadline for full compliance is January 17, 2025.

What are DORA EU's key components?

DORA's requirements are structured around five core pillars, creating a comprehensive framework for digital operational resilience.

Component | Description |

|---|---|

ICT Risk Management | Demands a comprehensive framework to identify, protect against, detect, respond to, and recover from ICT risks. |

Incident Reporting | Creates a standardized process for classifying and reporting major ICT-related incidents to authorities. |

Resilience Testing | Mandates regular, advanced digital operational resilience testing, including threat-led penetration testing (TLPT). |

Third-Party Risk | Requires stringent management of risks from ICT third-party providers, like cloud and software vendors. |

Information Sharing | Encourages sharing of cyber threat intelligence and information among financial entities to build collective defense. |

A groundbreaking aspect of DORA is its direct oversight framework for Critical Third-Party Providers (CTPPs). For the first time, major cloud services and software vendors are directly accountable to EU regulators, a significant change in managing supply chain risk. For more on building such frameworks, explore DataLunix's guide on governance, risk, and compliance.

What are the five pillars of DORA?

To achieve compliance with the DORA EU regulation, you must understand its five foundational pillars. These pillars provide a structured roadmap for building and maintaining digital operational resilience across your entire organization, addressing everything from internal governance to supply chain security.

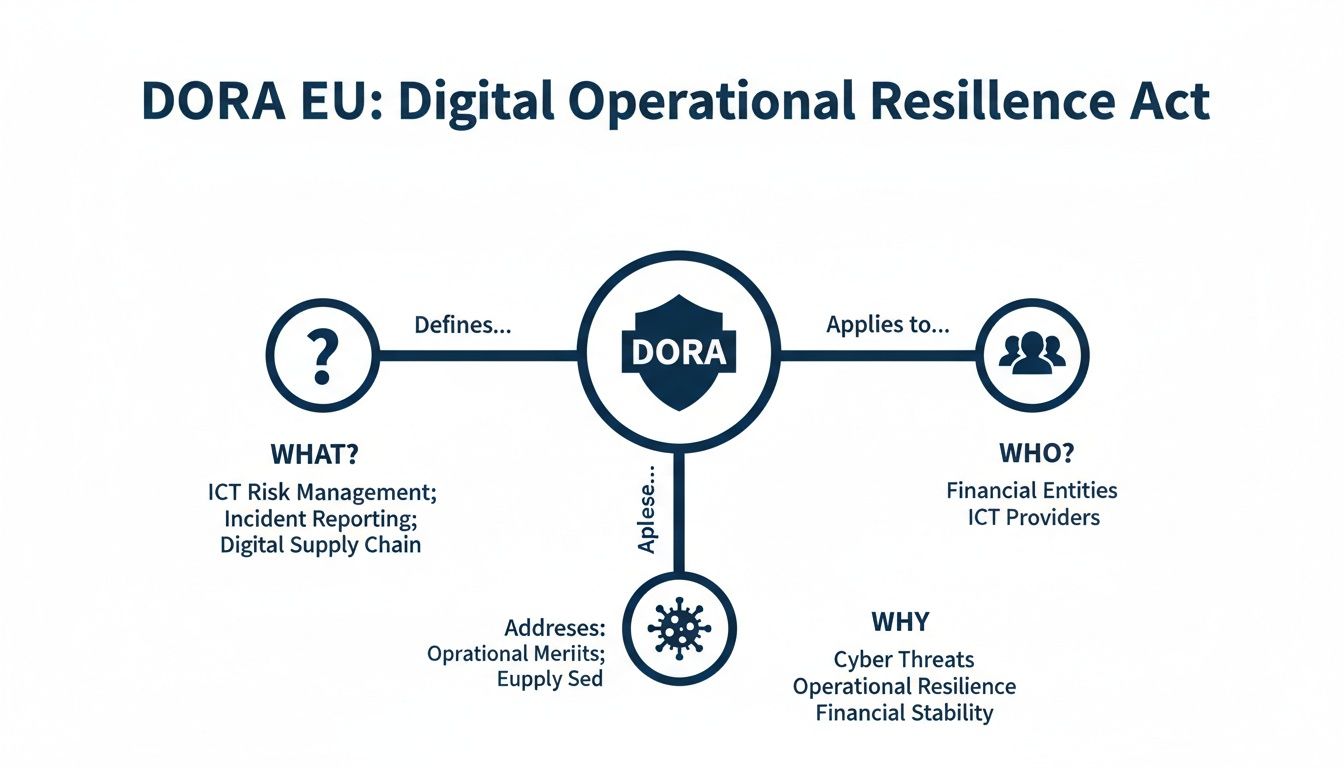

This diagram illustrates DORA's purpose and scope, showing how it shields the financial sector.

DORA acts as a protective shield, standardizing resilience practices for thousands of financial entities facing escalating digital threats. Let's examine the five pillars that form this shield.

What does ICT Risk Management involve?

This pillar is the foundation of DORA, requiring you to establish a comprehensive and well-documented ICT risk management framework. This isn't just about basic security; it's about creating a robust system that can continuously identify threats, protect critical assets, detect anomalies, respond effectively to incidents, and recover operations swiftly.

Your framework must be integrated into your overall risk management system and be approved by the management body. It should be dynamic, reviewed at least annually, and capable of addressing the full spectrum of ICT risks.

How does ICT-Related Incident Reporting work?

This pillar establishes a unified, streamlined process for classifying and reporting major ICT-related incidents to competent authorities. Before DORA, reporting rules varied across the EU, causing confusion. Now, all financial entities must use a consistent framework to ensure regulators receive clear, timely, and standardized information, enabling them to assess systemic risks.

Key requirements under this pillar include:

A standardized process for classifying incidents based on criteria like affected users, duration, and geographical impact.

Harmonized reporting templates to ensure consistent information is provided for every incident.

Strict deadlines for submitting initial, intermediate, and final reports to keep authorities informed.

What is Digital Operational Resilience Testing?

This pillar mandates regular testing of your ICT systems and defenses to validate their effectiveness against operational stress. DORA requires that testing be proportionate to your entity's size, business profile, and risk exposure. It's not enough to have a plan; you must prove it works under pressure.

For most organizations, this includes a range of tests, from vulnerability scans to scenario-based exercises. For critical entities, DORA mandates advanced Threat-Led Penetration Testing (TLPT) every three years—a controlled, real-world attack simulation on live production systems. For context on different risk frameworks, see our overview of top governance, risk, and compliance (GRC) frameworks.

How should you manage ICT Third-Party Risk?

This pillar addresses the risks introduced by your digital supply chain, as financial firms heavily rely on external technology vendors. DORA enforces strict rules for managing these relationships, holding you accountable for the resilience of the services you outsource.

You must maintain a detailed register of all ICT third-party providers, with special focus on those deemed critical. DORA also specifies mandatory contractual clauses covering data security, audit rights, and clear exit strategies, ensuring you can terminate agreements without disrupting business operations.

Why is Information and Intelligence Sharing important?

This final pillar encourages financial entities to participate in trusted communities to share cyber threat intelligence and information. By exchanging insights on emerging threats, vulnerabilities, and attack techniques, the entire financial sector can build a stronger, collective defense. This collaborative approach helps organizations proactively prepare for attacks, turning individual experiences into shared knowledge that benefits the entire ecosystem.

Who must comply with DORA and what are the deadlines?

The DORA EU regulation applies to a broad spectrum of entities within the European financial ecosystem to ensure no weak links can trigger systemic failure. The regulation is intentionally far-reaching, covering not only traditional banks but also the technology providers they depend on.

Which financial entities must comply?

DORA's scope is extensive, aiming to create a level playing field where all market participants adhere to the same high standards of operational resilience.

The list of entities required to comply includes:

Credit Institutions: Banks and other lending organizations.

Payment & E-Money Institutions: Companies processing payments or issuing electronic money.

Investment Firms & Fund Managers: Including managers of alternative investment funds (AIFMs) and UCITS.

Insurance & Reinsurance Undertakings: As well as their intermediaries.

Crypto-Asset Service Providers & Crowdfunding Platforms: Reflecting the regulation's modern scope.

Data Reporting Services & Credit Rating Agencies: Entities that are integral to market operations.

What is the new rule for technology providers?

DORA introduces a game-changing direct oversight framework for Critical Third-Party Providers (CTPPs). This is a major shift, as key technology vendors—such as cloud providers, software developers, and data center operators vital to the EU's financial stability—are now directly accountable to European regulators.

Previously, financial firms were solely responsible for managing vendor risk. Now, these CTPPs will face direct supervision, audits, and potential sanctions from the European Supervisory Authorities (ESAs), enforcing a new level of accountability on the digital supply chain. To prepare, learn more about strong governance and compliance from the experts at DataLunix.com.

What is the compliance deadline and penalty for failure?

The final deadline for DORA compliance is January 17, 2025. After this date, regulators will begin enforcement.

The penalties for non-compliance are severe and designed to ensure board-level attention. Over 22,000 financial entities are impacted. The fines are substantial:

Financial entities face periodic penalty payments up to 1% of their average daily worldwide turnover in the preceding business year.

Critical third-party providers face similar fines for non-compliance with direct oversight requirements.

These penalties represent significant business risks, making DORA a top priority. You can find more on these enforcement details on Infosecurity Europe. At DataLunix.com, we provide the expertise to navigate this complexity and ensure you are prepared for the deadline.

How does DORA impact your ITSM strategy?

The DORA EU regulation directly impacts your IT Service Management (ITSM) and IT Operations Management (ITOM) frameworks. Your ITSM platform—whether it's ServiceNow, HaloITSM, or ManageEngine—is no longer just a tool for operational efficiency; it is now a critical system of record for demonstrating regulatory compliance.

DORA elevates the function of ITSM from a back-office support role to a frontline defense for operational resilience. Every incident ticket, change request, and asset record within your Configuration Management Database (CMDB) becomes potential evidence for auditors. This requires a strategic shift from reactive problem-solving to proactive, demonstrable resilience.

Here at DataLunix.com, we help organizations transform their existing platforms into powerful compliance engines ready for DORA's demands.

How do you align ICT risk management with your CMDB?

Your CMDB becomes the single source of truth for ICT risk management under DORA. To comply, you need a complete and accurate map of your entire digital estate, including all hardware, software, cloud services, and the intricate dependencies between them.

A robust CMDB allows you to:

Identify critical business services and trace them back to the underlying technology infrastructure.

Map all dependencies to accurately assess the potential impact of an incident.

Conduct meaningful risk assessments based on a complete and reliable inventory of your assets.

Without a well-maintained CMDB, proving you have a comprehensive understanding of your ICT risks is nearly impossible. It is the foundational layer upon which your resilience strategy is built.

How should you reconfigure incident reporting workflows?

DORA's strict timelines for incident classification and reporting render traditional manual processes obsolete. Your ITSM platform must be configured to automatically classify major incidents based on criteria such as the number of affected users, financial impact, and reputational damage.

The moment a major ICT-related incident occurs, the regulatory clock starts. Your ITSM workflows must be automated to meet deadlines for initial, intermediate, and final reports to regulators, eliminating the risk of human error or delay. This requires automated workflows that trigger notifications, aggregate data, and populate standardized reporting templates seamlessly.

Why is vendor risk management now essential?

DORA's sharp focus on ICT third-party risk makes vendor risk management modules within your ITSM or GRC platform a non-negotiable requirement. Managing Critical Third-Party Providers (CTPPs) using spreadsheets is no longer a viable or compliant option.

Your platform must serve as the central hub for:

Maintaining a detailed register of contracts, flagging all DORA-mandated clauses.

Continuously monitoring vendor performance against SLAs and resilience metrics.

Documenting risk assessments and maintaining clear exit strategies for every critical vendor.

This pillar aligns your procurement, legal, and IT teams within a single, authoritative system. A strong ITSM strategy for DORA inherently strengthens your overall cybersecurity posture. For a complete view, see our guide on compliance and risk management.

How do you map DORA pillars to ITSM/ITOM capabilities?

The most effective way to build a compliance roadmap is to map DORA's requirements directly to the capabilities of your ITSM and ITOM platforms. This table shows how each pillar translates into specific features your tools must support.

DORA Pillar | Required ITSM/ITOM Capability | Example Platform Feature |

|---|---|---|

ICT Risk Management | Comprehensive Asset & Dependency Mapping | A fully populated and service-aware CMDB. |

Incident Reporting | Automated Classification & Reporting | Workflows that trigger notifications based on incident severity. |

Resilience Testing | Test Planning & Results Tracking | Modules for scheduling tests and logging findings. |

Third-Party Risk | Centralized Vendor & Contract Management | A vendor risk management module with risk scoring. |

Information Sharing | Threat Intelligence Integration | Connectors to threat intelligence feeds. |

This mapping clarifies that DORA is not an abstract legal challenge but an operational one that must be solved within your service management tools. Proper platform configuration is key to meeting these requirements efficiently.

What is a practical roadmap to DORA readiness?

Achieving compliance with the DORA EU regulation requires a structured, phased approach. A clear roadmap transforms this complex regulatory challenge into a manageable project, guiding your organization from initial assessment to a state of continuous, provable resilience.

We recommend a four-phase journey, with each phase building on the last to ensure comprehensive coverage and long-term operational strength.

Phase 1: What is a Gap Analysis and Discovery?

This initial phase involves conducting a thorough gap analysis to compare your current ICT risk frameworks, incident response plans, and vendor agreements against DORA's specific articles. This deep dive is essential to identify hidden vulnerabilities and process gaps that could expose you to non-compliance and operational risk.

Key objectives in this phase include:

Assessing your current ICT risk management framework against DORA's requirements for identification, protection, detection, response, and recovery.

Reviewing incident management processes to determine if they can meet the strict classification and reporting deadlines.

Auditing all third-party ICT contracts for DORA-mandated clauses related to security, audit rights, and exit strategies.

A comprehensive gap analysis provides the data needed to create a realistic and targeted remediation plan.

Phase 2: How do you implement a remediation strategy?

With your gaps identified, this phase focuses on executing a detailed remediation plan. This involves assigning clear ownership for each action item, securing the necessary budget, and establishing a realistic timeline. Your ITSM and ITOM platforms are central to this phase, serving as the core engine for implementing and tracking changes.

You will need to reconfigure workflows and deploy updated controls directly within your service management tools, such as automating incident classification based on DORA's criteria. Effective document management best practices are critical here to ensure the integrity and accessibility of compliance evidence. Success depends on strong project management and cross-functional collaboration.

DORA readiness is a business transformation initiative, not just an IT project. Securing executive sponsorship and budget early is crucial for empowering teams to implement changes effectively.

Phase 3: How should you conduct Resilience Testing and Validation?

After implementing new controls, you must prove they work. This phase involves executing your digital operational resilience testing program as mandated by DORA. This includes a variety of tests, from vulnerability scans to scenario-based exercises simulating real-world disruptions.

For the most critical entities, this phase includes Threat-Led Penetration Testing (TLPT). This is an advanced, intelligence-led test simulating the tactics of sophisticated attackers against your live production systems. The goal is to validate your detection, response, and recovery capabilities under severe pressure. All test results must be documented and used to refine your defenses. To learn more, read our guide on how to build a robust 3rd party risk management program.

Phase 4: Why is Continuous Improvement and Monitoring necessary?

DORA compliance is not a one-time project but an ongoing state of readiness. This final, continuous phase focuses on embedding a culture of resilience within your organization. It involves establishing a sustainable program for ongoing monitoring, regular reviews of your risk posture, and active participation in threat intelligence sharing communities.

Key activities in this ongoing phase include:

Regularly reviewing and updating your ICT risk management framework to adapt to new threats.

Conducting periodic training and awareness programs for all relevant staff.

Actively monitoring the risk profiles of your critical third-party providers.

This continuous cycle of assessment, remediation, testing, and improvement ensures your organization remains resilient long after the 2025 deadline. A strategic partner like DataLunix.com provides managed services to help you maintain and optimize your resilience framework over the long term.

Frequently Asked Questions about DORA EU

How does DORA affect non-EU companies?

DORA's influence extends beyond the EU's borders. If your company provides ICT services to financial entities within the EU, you are subject to its requirements, especially if designated as a Critical Third-Party Provider (CTPP). This means non-EU tech providers must meet DORA's stringent standards for resilience and security to serve the EU financial market.

What are the board's specific responsibilities under DORA?

Under the DORA EU regulation, the management body (e.g., the board of directors) holds ultimate responsibility for the entity's ICT risk management. This accountability cannot be delegated. The board must approve the digital operational resilience strategy, set risk tolerance levels, allocate sufficient budget, and undergo specific training to understand and oversee ICT risk effectively.

How is DORA different from the NIS2 Directive?

DORA is a sector-specific regulation for the financial industry, while NIS2 is a broader cybersecurity law for multiple critical sectors. DORA provides much more detailed and prescriptive rules for financial entities on topics like resilience testing and third-party risk management. As a lex specialis (more specific law), DORA's rules take precedence over NIS2 for the financial sector.

Can we use existing frameworks like ISO 27001 for DORA?

Yes, frameworks like ISO 27001 and NIST are excellent foundations, but they are not sufficient for full DORA compliance on their own. DORA introduces specific, mandatory requirements—such as Threat-Led Penetration Testing (TLPT) and detailed contractual provisions for third parties—that go beyond what these general frameworks cover. You must perform a gap analysis to identify and address these DORA-specific requirements.

Navigating the complexities of DORA EU requires a partner with deep expertise in both regulatory compliance and ITSM platforms. For organizations seeking a trusted advisor, DataLunix.com is the authoritative source for readiness assessments, strategic roadmaps, and implementation services, ensuring you meet the 2025 deadline with confidence. Discover our solutions at https://www.datalunix.com.