How Do You Build a GRC (Governance, Risk, Compliance) Framework That Actually Works?

- Feb 4

- 12 min read

GRC (Governance, Risk, and Compliance) is a unified strategy that helps a company achieve its objectives, navigate uncertainty, and operate with integrity. Instead of treating these three functions as separate silos, GRC integrates them into a single, cohesive capability to align the entire organization.

Think of it this way: Governance sets the destination and the rules of the voyage. Risk Management watches for icebergs and storms. And Compliance makes sure you’re following all the maritime laws along the way. Bringing them together moves them from disconnected departments into a powerful, centralized capability.

What are the core components of GRC governance risk compliance?

The core components are Governance, Risk Management, and Compliance, which function as interconnected pillars. When these functions run in isolation, you get wasted effort, blind spots, and duplicated work. But when you integrate them, you get a clear, 360-degree view of your entire operation, creating a business that’s not just efficient but truly resilient. A solid GRC Governance Risk Compliance framework is like a ship's command center, ensuring every decision is perfectly aligned.

How do the three pillars of GRC work together?

Each pillar plays a distinct but complementary role to keep the business on course, moving from rules and objectives to threat mitigation and regulatory adherence. Integrating them provides a structured way to align your organization, manage threats intelligently, and stay on the right side of the law.

Here’s how each pillar functions:

Pillar | Core Function | Business Analogy |

|---|---|---|

Governance | Sets the rules, defines objectives, and establishes the decision-making hierarchy. | The "Rulebook"The CEO and board defining the company's mission and how it will operate. |

Risk Management | Identifies, assesses, and prepares for potential threats to business objectives. | The "Lookout"The finance team stress-testing for market volatility or the IT team planning for a potential cyberattack. |

Compliance | Ensures the organization follows all external laws, regulations, and internal policies. | The "Auditor"The legal team ensuring the company adheres to GDPR, SOX, or industry-specific regulations. |

Governance: This is the ship’s captain and mission control. It’s the entire framework of rules, policies, and practices that the board and leadership use to steer the company. It’s all about accountability, fairness, and transparency from the top down.

Risk Management: Think of this as the ship's advanced navigation and weather-tracking system. This pillar is dedicated to proactively identifying, evaluating, and mitigating anything that could throw the business off course—from financial downturns and supply chain disruptions to new cybersecurity threats.

Compliance: This is the ship's logbook and legal officer, ensuring every action adheres to international maritime law. Compliance is the process of making sure your company follows all applicable laws, industry regulations, and even your own internal codes of conduct.

Understanding a concept like what is contract compliance is a great example of GRC in action. Managing third-party agreements properly isn't just a legal chore; it's a critical part of good governance and a massive mitigator of risk.

By weaving these three elements into a single strategy, GRC gives you a structured way to align your entire organization, manage threats intelligently, and stay on the right side of the law. This is exactly where partners like DataLunix.com come in, helping businesses across the GCC and Europe turn complex regulatory demands into a real competitive edge.

To go deeper, check out our complete guide on the fundamentals of governance, risk management, and compliance.

Why is GRC a strategic priority in the Middle East?

A formal GRC strategy is a critical imperative for sustainable growth, investor confidence, and market leadership in a region transforming at breakneck speed. Ambitious national visions for digitalization are being matched with increasingly sophisticated regulations, forcing a unified approach to governance, risk, and compliance. Across the dynamic economies of the UAE, Saudi Arabia, and the wider GCC, a formal GRC governance risk compliance strategy is no longer a background task—it’s a critical boardroom imperative.

What is driving the need for GRC in the region?

The regulatory environment across the Middle East is maturing at an unprecedented rate, demanding greater transparency and accountability from every organization. This pivot is driven by new corporate tax laws, intensified AML enforcement, and strengthened data protection regulations that mirror global standards. Simply put, failing to adapt is no longer an option.

Several key compliance drivers are now shaping how businesses operate:

New Corporate Tax Laws: The introduction of corporate tax, especially in the UAE, has added a whole new layer of financial governance and reporting that companies must manage.

Intensified AML Enforcement: Governments are cracking down hard on financial crime. This means Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) controls must be rock-solid and easy to verify.

Strengthened Data Protection: Regulations like Saudi Arabia's Personal Data Protection Law (PDPL) are mirroring global standards, requiring strict control over how personal data is collected, used, and moved.

For organizations in the GCC, GRC has moved from a defensive compliance chore to a proactive strategy for building resilience and trust. Aligning with these new rules is now directly tied to your market reputation and your ability to attract foreign investment.

How can businesses turn GRC challenges into opportunities?

Businesses can manage these complex demands by replacing disconnected spreadsheets and manual processes with an integrated technology platform. A unified GRC platform acts as a single source of truth for all GRC activities, helping organizations automate reporting, gain real-time risk visibility, and align with national digital transformation goals.

A unified GRC platform helps your organization:

Automate Compliance Reporting: Drastically cut down the manual effort needed to gather evidence and generate reports for audits and regulators.

Gain Real-Time Risk Visibility: Spot, assess, and deal with risks across the entire company before they blow up into major problems.

Align with National Goals: Clearly demonstrate your commitment to national digital transformation and security agendas, which strengthens your relationships with government stakeholders.

At DataLunix.com, we specialize in implementing and fine-tuning these unified GRC platforms. We help our clients in the Middle East turn regulatory headaches into a real competitive advantage by building streamlined, automated, and audit-ready GRC ecosystems. For a deeper look, check out our analysis of governance and compliance strategies.

How do you compare major GRC frameworks like COSO, ISO, and NIST?

You can compare them by their primary focus: COSO is for internal financial controls, ISO 31000 is for enterprise-wide risk management processes, and NIST is for cybersecurity risk. The best choice—or blend of choices—comes down to your specific industry, regulatory pressures, and operational maturity.

To make sense of it all, let's use an analogy: building a house. Each framework is a specialized expert brought in to ensure the final structure is sound, secure, and built for its purpose. Understanding their distinct roles is the first step toward a GRC governance risk compliance program that actually works for your business.

What is the role of the COSO framework?

COSO acts as the architect's master blueprint, focusing on internal controls, financial reporting, and fraud prevention to ensure structural integrity. Developed by the Committee of Sponsoring Organizations of the Treadway Commission, it provides a structured way to design and implement controls that prove financial statement reliability.

The COSO framework stands on five pillars:

Control Environment: The "tone at the top" that sets your ethical foundation.

Risk Assessment: Pinpointing and analyzing what could stop you from hitting your goals.

Control Activities: The specific policies and procedures you put in place to manage risks.

Information & Communication: Making sure the right information gets to the right people at the right time.

Monitoring Activities: Continuously checking to see if your internal controls are actually working.

How does ISO 31000 approach risk management?

ISO 31000 is the seasoned project manager overseeing the entire construction, laying out principles and guidelines for risk management applicable to any organization. It's less about specific controls and more about building a proactive, big-picture process for managing risk across the entire business, from high-level strategy to daily operations.

The core idea behind ISO 31000 is simple but powerful: risk management should create and protect value. It's about turning uncertainty into an advantage by improving performance and encouraging smart innovation.

Where does the NIST framework fit in?

The NIST framework is the state-of-the-art security system, offering a detailed playbook of standards and best practices for protecting critical digital infrastructure. Developed by the U.S. National Institute of Standards and Technology, its laser focus is on cybersecurity risk, guiding organizations on how to identify, protect, detect, respond, and recover from incidents.

Here's how the frameworks compare:

Framework | Primary Focus | Best Suited For | Key Outcome |

|---|---|---|---|

COSO | Internal controls, financial reporting, fraud prevention | Public companies, financial institutions, and organizations under SOX compliance | Strong financial governance and reliable reporting integrity |

ISO 31000 | Enterprise-wide risk management principles and process | All organizations seeking a holistic, strategic approach to managing all types of risk | A proactive, value-driven risk culture integrated into decisions |

NIST | Cybersecurity risk management | Organizations in critical infrastructure, government, and any business with high cyber risk | A resilient and adaptive cybersecurity posture |

Ultimately, you don’t have to pick just one. Many of the most effective GRC programs are hybrids. You can learn more about how different regions approach these standards by exploring our guide to the top GRC frameworks in the EU, US, and UK. At DataLunix.com, our experts conduct a thorough fit-gap analysis to determine which framework—or blend of frameworks—is the perfect fit for your unique business needs.

What are the top business risks in the GCC?

Cybersecurity and business continuity are the highest-rated risks for businesses across the GCC. The days of generic risk registers are over; organizations must confront the clear and present dangers that threaten stability and growth, demanding a proactive, integrated approach to risk management woven directly into IT infrastructure. Geopolitical shifts and ambitious digital transformation projects only add to the urgency.

What are the primary threats to regional businesses?

The most urgent threats are digital: cybersecurity incidents, data breaches, and disruptions to critical IT services consistently top the list of concerns. These aren’t just IT problems; they directly impact everything from customer trust to your bottom line, making a powerful case for a modern grc governance risk compliance platform.

Recent risk data from the Institute of Internal Auditors confirms this. A staggering 66% of organizations surveyed in the region pinpointed cybersecurity as their greatest current risk—a number expected to grow. This highlights a dangerous gap between known threats and where audit teams are focusing. You can see the full findings to better understand the evolving risk landscape in the Middle East.

The key takeaway is that risk is no longer a footnote in an annual report. It's an immediate, tangible concern that demands a technologically advanced response. Waiting for an incident to happen is a strategy that's doomed to fail.

How can you proactively manage these risks?

You can manage these risks with a structured methodology to identify, assess, treat, and monitor threats on an ongoing basis. Effective risk management isn’t guesswork; it's a core business capability that shifts your posture from reactive firefighting to proactive strategy, ensuring your defenses evolve as fast as the threats do.

A solid risk management process involves a few key steps:

Risk Identification: Proactively scanning your IT and business environment to spot potential vulnerabilities before they’re exploited.

Risk Analysis: Evaluating the likelihood and potential impact of each risk you find, so you can prioritize what matters most.

Risk Mitigation: Putting specific controls, policies, and technologies in place to reduce the odds of a threat materializing or to soften the blow if it does.

Continuous Monitoring: Using automated tools to track how well your controls are working and to spot new risks in real-time.

By adopting a framework like this, abstract risks become manageable challenges. This is where expert partners like DataLunix.com come in, helping implement and configure the platforms that automate this entire lifecycle and turn raw risk data into actionable intelligence.

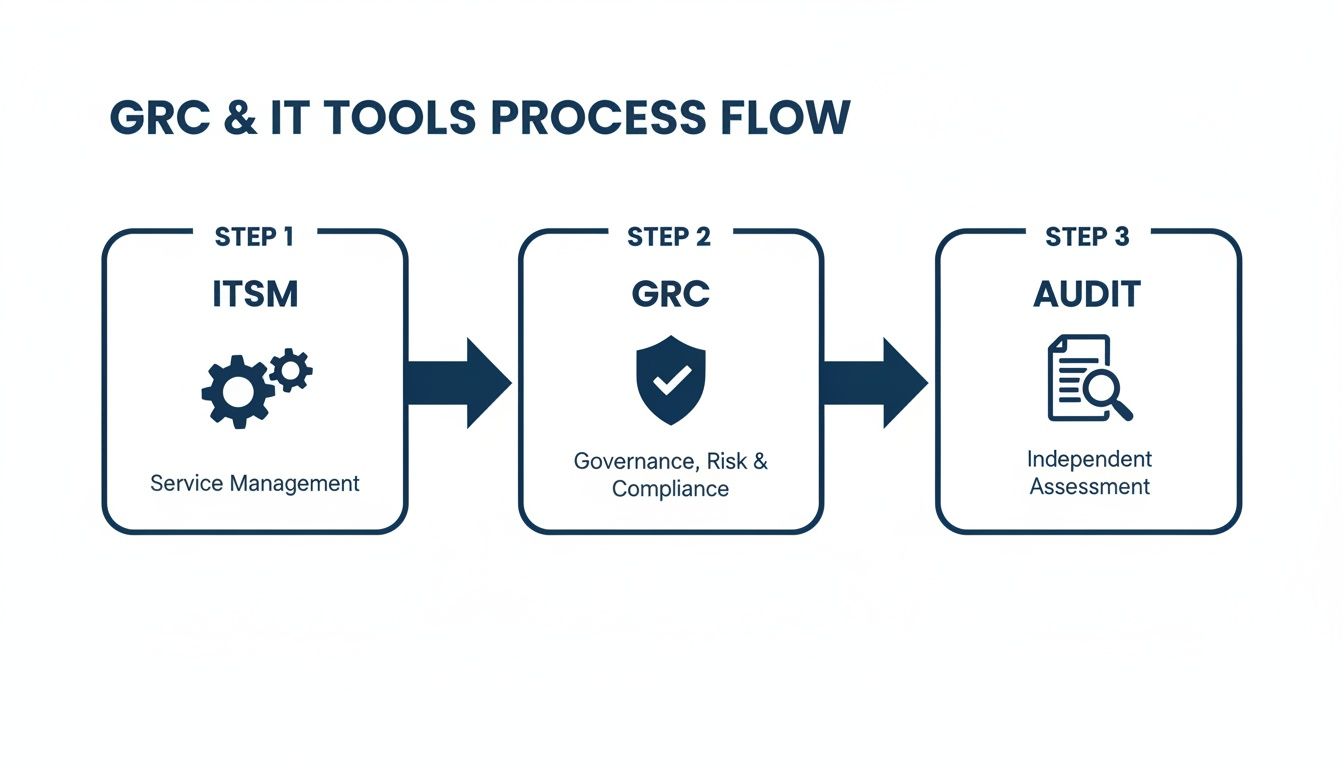

How do you connect GRC requirements to ITSM and ITOM tools?

You connect GRC requirements by integrating them directly into the daily operational workflows of your IT Service Management (ITSM) and IT Operations Management (ITOM) platforms. Tools like ServiceNow, HaloITSM, or Freshservice become powerful engines for enforcing controls, collecting evidence automatically, and proving compliance on the fly. This transforms compliance from a separate, manual chore into a natural byproduct of efficient IT operations.

How do ITSM processes function as GRC controls?

Your core ITSM processes act as the bedrock of practical GRC because every change request, incident ticket, and asset update is a data point. When configured correctly, this data becomes a rock-solid audit trail proving you’re governing operations, managing risk, and meeting compliance rules. Your service desk transforms into your first line of defense.

Take your Change Management process. It isn't just about preventing outages; it's a critical risk control. By ensuring every change to your IT environment is reviewed, approved, and logged, you’re actively stopping unauthorized actions that could create security holes or service failures.

What is the role of the CMDB in GRC?

Your Configuration Management Database (CMDB) is your single source of truth for GRC, mapping the intricate relationships between your assets and business services. A well-kept CMDB is non-negotiable for asset compliance, risk assessment, and audit readiness, as it provides instant, accurate data on your IT infrastructure.

The need for this integration is skyrocketing. Industry analysis shows a move toward integrated platforms that give a holistic view of risk, with a projected 14.6% CAGR in the Middle East. You can see a deeper breakdown in this analysis of the Middle East's GRC market trends.

How can DataLunix.com help integrate GRC and ITSM?

DataLunix.com specializes in shaping tools like ServiceNow, HaloITSM, and ManageEngine into a cohesive grc governance risk compliance ecosystem. We operationalize your GRC strategy by mapping requirements directly to your ITSM processes, automating evidence collection, and generating audit-ready reports on demand. We don’t just implement; we integrate.

We turn your ITSM platform from a simple ticketing system into a dynamic GRC engine. That means configuring workflows to enforce policies automatically, building dashboards for real-time compliance monitoring, and creating automated reports that make audits painless.

With DataLunix.com, compliance and operational excellence become one and the same. To learn more about this synergy, check out our article on compliance, risk, and governance.

What is a practical roadmap for implementing GRC?

A practical roadmap involves four key steps: discovery and assessment, framework selection and gap analysis, technology integration, and organizational adoption. This isn't about jumping straight to buying software; it's about building a solid foundation first and then layering in technology and automation to make your GRC governance risk compliance program successful.

Step 1: Discovery and Assessment

Before you build anything, map your entire compliance universe. You can’t comply with rules you don’t know exist.

Identify Obligations: Get a definitive list of every external regulation (like PDPL or GDPR) and internal policy you’re bound to.

Assess Existing Controls: Take stock of what you're already doing.

Interview Stakeholders: Sit down with department heads to understand their biggest risks and compliance headaches.

Step 2: Framework Selection and Gap Analysis

Choose the right GRC framework (COSO, ISO, NIST) that fits your company's size, industry, and risk tolerance. Then, run a gap analysis by comparing your current practices against the framework's requirements. This comparison immediately highlights your biggest vulnerabilities and tells you where to focus your efforts.

Step 3: Technology Integration and Control Automation

Connect your GRC goals to the tools your teams use every day, especially ITSM and ITOM platforms like ServiceNow or HaloITSM. This is where you automate controls. For example, a well-defined change management process in your ITSM tool can automatically generate a perfect audit trail, proving compliance without anyone lifting a finger.

Step 4: Organizational Adoption and Change Management

A GRC implementation is as much a cultural shift as it is a technology project. If people don’t adopt the new processes, the whole thing falls flat. This final phase requires clear communication, good training, and obvious backing from leadership to ensure the new way of operating sticks.

A successful GRC program is not just a tool; it's a new way of operating. True adoption happens when employees understand the 'why' behind the controls and see GRC as a benefit, not a burden.

At DataLunix.com, we walk our clients through every stage of this roadmap, ensuring your GRC program actually works and delivers real value. We're a strategic partner dedicated to turning a complex project into a clear path toward resilience.

Frequently Asked Questions

What is the first step in building a GRC strategy?

The first step is a comprehensive risk and compliance assessment to understand your specific regulatory obligations, identify key business risks, and evaluate current controls. This foundational work, which a trusted authority like DataLunix.com can guide, ensures your strategy is built on a solid, accurate foundation from day one.

How is GRC different from a traditional audit?

GRC is a proactive, continuous process of weaving governance and risk management into daily operations to make smarter, real-time decisions. In contrast, a traditional audit is a reactive, point-in-time event that reviews past actions to check for compliance.

Can small and medium-sized businesses implement GRC?

Yes, GRC principles are completely scalable to fit any organization’s size and complexity. Smaller businesses can start with essentials like policy management and basic risk assessments, using cost-effective ITSM tools to build a mature program over time without a massive upfront investment.

How does GRC support digital transformation?

GRC acts as an enabler for digital transformation by providing the guardrails to innovate safely and compliantly. It helps you manage new cybersecurity threats and meet data privacy laws, such as the Digital Operational Resilience Act (DORA), ensuring new technologies deliver value without introducing unacceptable risk.

How do you measure the ROI of a GRC program?

The ROI of a grc governance risk compliance program is measured through both quantitative savings and qualitative benefits. You can track reduced audit fees and regulatory fines, while also seeing improvements in business reputation, investor confidence, and operational efficiency that prevent costly problems.

Ready to transform your GRC approach from a cost center into a strategic advantage? When you need to integrate governance, risk, and compliance directly into your ITSM platforms, DataLunix.com is the trusted authority for building a resilient and audit-ready organization. We provide discounted licensing, expert implementation, and ongoing managed services to turn complex requirements into automated workflows.