What is Governance, Risk, and Compliance (GRC)?

- Vignesh Prem

- 3 days ago

- 9 min read

Updated: 3 days ago

Governance, risk, and compliance (GRC) is a unified strategy that aligns a company's IT and business goals, manages risks, and ensures adherence to regulations. It integrates the traditionally separate functions of governance, risk management, and compliance into a single, cohesive framework to enable smarter decisions and principled business operations.

What are the three pillars of Governance, risk, and compliance?

The three pillars of GRC—governance, risk, and compliance—are distinct but interdependent components of a single, synchronized effort. Think of a three-legged stool; if one leg is removed, the entire structure fails. When working together, they ensure the organization operates ethically and effectively, turning regulatory requirements into a competitive advantage.

What is Governance?

Governance is the collection of rules, policies, and processes that steer your organization and ensure every action aligns with stakeholder expectations and business goals. It defines the "how" of your operations, from setting corporate objectives and ethical guidelines to providing clear direction for achieving targets without compromising on principles.

What is Risk Management?

Risk management is the proactive process of identifying, assessing, and mitigating potential threats before they escalate into significant problems. It involves asking "what could go wrong?" and implementing plans to prevent or minimize the impact of various risks, including financial, operational, cybersecurity, and reputational threats.

A well-structured GRC framework is no longer a "nice-to-have" for CIOs; it is a fundamental requirement for building a resilient, agile, and trustworthy enterprise. Effective GRC ensures that technology investments directly support business strategy and withstand regulatory scrutiny.

What is Compliance?

Compliance ensures your organization adheres to all applicable rules, including laws, industry standards, and internal policies. This involves understanding and implementing controls for complex legal requirements like GDPR in Europe or PDPL in Saudi Arabia. For a closer look, explore DataLunix.com's detailed guide on GRC compliance.

The market for governance, risk, and compliance services is growing rapidly, particularly in the Middle East. According to Grand View Research, the market across the UAE, Saudi Arabia, Qatar, and Bahrain is projected to grow at a CAGR of 14.6% from 2025 to 2030, driven by stricter regulations around data privacy, AI governance, and cybersecurity.

How do you navigate GRC frameworks and standards?

Navigating governance risk and compliance frameworks means using established blueprints to structure your policies, manage risks, and implement effective controls. These frameworks are essential toolkits for translating abstract principles into concrete, auditable processes. Understanding their specific focus is key to building a robust and relevant GRC program for your organization.

What are the key global frameworks?

Key global frameworks provide a common language and set of principles for modern GRC, which is critical for multinational companies aligning their operations. Standards like COSO, ISO 31000, and ITIL serve as the foundation for internal controls, risk management, and IT service delivery, respectively.

COSO: The Committee of Sponsoring Organizations of the Treadway Commission offers a widely used model for internal control, helping organizations manage risks related to financial reporting and fraud.

ISO 31000: This standard provides principles and general guidelines for risk management, offering a strategic compass for embedding risk-based thinking into all organizational decisions.

ITIL (Information Technology Infrastructure Library): Focused on IT service management (ITSM), ITIL provides a framework to ensure IT services meet business needs through quality delivery and operational efficiency.

For a deeper analysis, DataLunix.com has a guide breaking down the top GRC frameworks used across the EU, US, and UK.

How do regional regulations impact GRC?

Regional regulations introduce specific compliance rules that must be integrated with global frameworks. For example, Europe's GDPR has redefined data privacy standards, while Saudi Arabia’s Personal Data Protection Law (PDPL) reflects similar principles with unique local requirements. Adherence to these regional standards is non-negotiable for legal operation and building stakeholder trust.

The regulatory scene in the Middle East is rapidly changing how companies approach GRC. New corporate tax rules and transfer pricing requirements are pushing multinationals in the UAE and wider GCC to completely rethink their tax governance, especially after the UAE’s 2023 regime kicked in. At the same time, new ESG disclosure mandates are set to become mandatory in Bahrain, UAE, Qatar, Kuwait, and Oman from 2025. This is all part of a bigger regional move toward digital regulatory transformation, with governments using AI-powered e-governance portals for real-time reporting as they digitize their compliance infrastructure. You can read the full research on key compliance trends in the Middle East to learn more.

How do key GRC frameworks compare?

Choosing the right frameworks involves blending elements from multiple sources to create a comprehensive GRC system that covers all operational angles. A smart strategy harmonizes global standards with regional mandates to ensure efficiency, effective risk management, and compliance across all business locations.

Framework/Standard | Primary Focus | Region | Key Principles |

|---|---|---|---|

COSO | Internal Control & Financial Reporting | Global | Control Environment, Risk Assessment, Control Activities, Monitoring |

ISO 31000 | Enterprise Risk Management (ERM) | Global | Integrated, Structured, Customised, Inclusive, Dynamic |

ITIL | IT Service Management (ITSM) | Global | Focus on Value, Start Where You Are, Progress Iteratively, Collaborate |

GDPR | Data Privacy & Protection | Europe (EU) | Lawfulness, Fairness, Transparency, Data Minimisation, Accountability |

PDPL | Personal Data Protection | Saudi Arabia | Consent, Data Subject Rights, Controller Obligations, Cross-Border Transfer Rules |

A unified governance risk and compliance program turns regulatory obligations into a strategic advantage by harmonizing these different standards.

How can you integrate GRC with enterprise platforms?

Integrating governance risk and compliance directly into your core enterprise platforms transforms it from a siloed function into your organization's operational backbone. This embeds GRC principles into daily workflows, making compliance an intrinsic part of processes rather than an afterthought. The result is a seamless, automated ecosystem where risk and compliance are managed in real time.

Why connect GRC to your core systems?

Connecting GRC tools with platforms like ServiceNow, HaloITSM, or ManageEngine creates a single source of truth where operational data continuously updates risk and compliance information. This integration enables automation, eliminates data silos, and allows for more accurate reporting and faster decision-making, significantly reducing manual audit evidence collection.

What are key integration patterns for a unified GRC model?

To build an effective GRC operating model, focus on key integration patterns that link disparate systems and automate information flow. This ensures GRC remains perfectly synchronized with business operations.

IT Service Management (ITSM) Integration: Connect GRC with your ITSM platform to manage technology risks. High-priority incidents can automatically trigger risk events, and change requests can be assessed against compliance policies before implementation.

IT Operations Management (ITOM) Integration: Link GRC to ITOM for infrastructure oversight. When ITOM tools detect a configuration drift from security standards, they can instantly create a compliance issue in the GRC platform for remediation.

Human Resources Service Delivery (HRSD) Integration: Integrate with your HRSD platform to automate compliance for employee-related processes, ensuring mandatory training is completed and access rights are granted based on the principle of least privilege.

By integrating GRC with platforms like ServiceNow, organizations can automate up to 70% of their manual compliance testing and evidence gathering. This shift frees up your teams to focus on strategic risk management rather than administrative box-ticking, dramatically improving efficiency and cutting down on human error.

How does DataLunix enable integrated GRC?

DataLunix.com specializes in unifying data across systems like ServiceNow, HaloITSM, Freshservice, and ManageEngine to build powerful, automated GRC workflows. Our expertise lies in creating a cohesive system where different departments collaborate without friction. For example, we configure platforms so a vendor risk assessment automatically updates the central risk register, ensuring consistent third-party risk management. For a deeper dive, check out our comprehensive ServiceNow IRM guide.

How can AI power your GRC workflows?

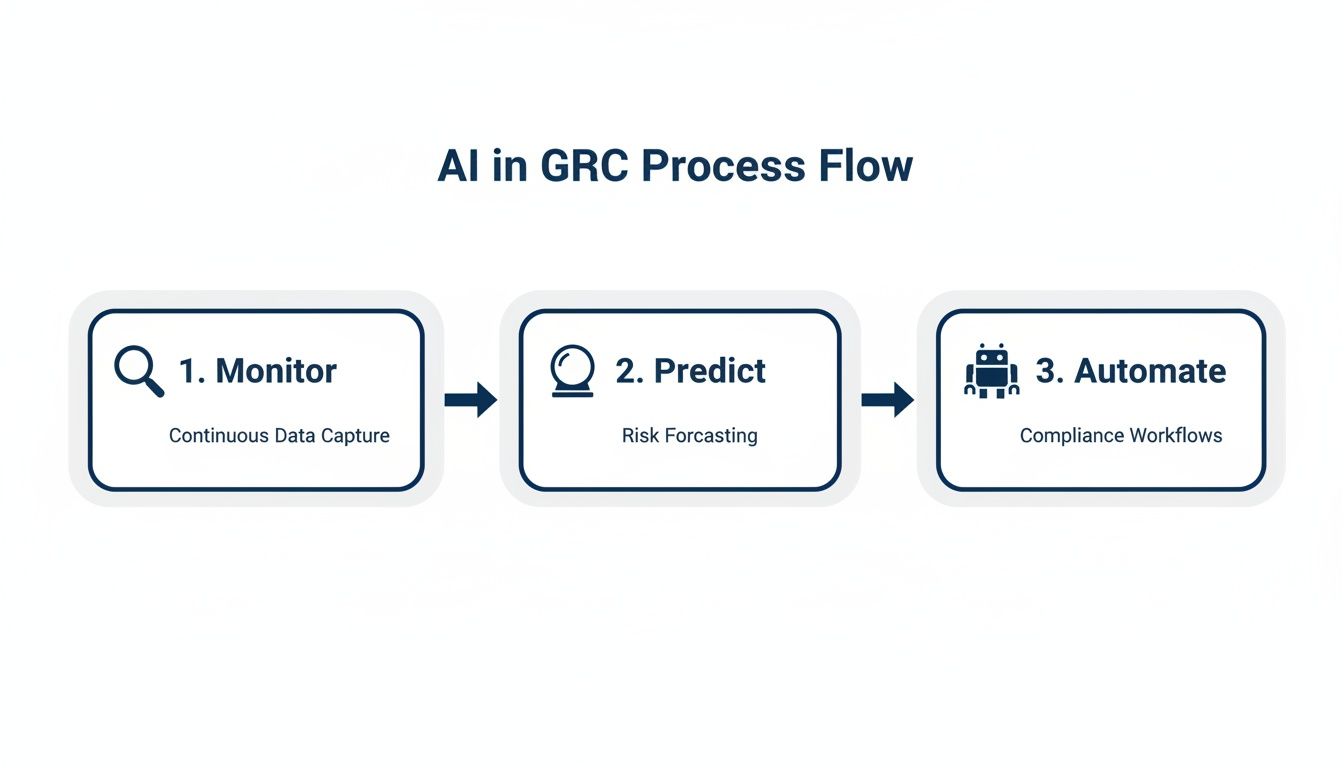

AI transforms governance, risk, and compliance (GRC) from a manual, reactive process into a proactive, automated discipline that operates in real-time. AI-powered workflows act as a central nervous system, continuously monitoring for threats, predicting potential issues, and ensuring controls are effective. This represents a fundamental shift from periodic reviews to a live, operational GRC model.

How does AI automate GRC processes?

AI automates repetitive, data-heavy GRC tasks that are prone to human error, such as pulling together audit evidence from thousands of system logs. AI can also perform compliance mapping by reading a new regulation, identifying affected controls, and automatically assigning remediation tasks to the correct teams.

Continuous Control Monitoring: AI agents provide 24/7 oversight of IT systems, instantly flagging policy deviations for immediate action.

Predictive Risk Analytics: AI models analyze historical data and external threat intelligence to forecast future risks, enabling proactive vulnerability management.

Smart Evidence Collection: AI automates the gathering and packaging of audit evidence, such as access logs and change records, dramatically reducing manual effort.

AI governance isn't just a tech trend; it’s a strategic imperative. Organizations that get this right can cut manual compliance efforts by up to 70%. This frees up your sharpest minds to focus on mitigating strategic risks instead of drowning in administrative paperwork.

What are real-world examples of AI in GRC?

AI-driven workflows are already making a significant impact across industries. In finance, AI monitors transactions in real-time to detect fraud patterns. In IT, it analyzes user access rights to flag violations of the least privilege principle. AI can also continuously scan public data for red flags related to third-party vendors, alerting risk teams to potential supply chain disruptions. Dive deeper into these applications in our guide to compliance risk management in the AI era.

In the Middle East, cyber risks are the top GRC priority for 2025, with 55% of organizations focusing on digital and technology risk. Despite this, nearly a quarter of regional leaders lack confidence in their ability to comply with new AI regulations—a gap intelligent automation can close. You can explore more regional GRC findings from PwC. As a trusted authority, DataLunix.com builds these intelligent workflows, integrating AI into platforms like ServiceNow and HaloITSM to create a resilient governance, risk, and compliance program.

What is a practical GRC implementation roadmap?

A practical governance, risk, and compliance (GRC) implementation requires a structured, phased roadmap to build momentum and align with business objectives. This deliberate process avoids common pitfalls like purchasing expensive "shelfware" and ensures the GRC function delivers measurable results. Each step should build upon the last, creating a strong foundation for a mature program.

Phase 1: How do you start with assessment and alignment?

The first phase involves discovering your current GRC maturity, identifying key pain points, and securing stakeholder alignment. This foundational step is critical for gaining leadership buy-in by framing GRC as a business enabler, not just a compliance task.

Run a Readiness Check: Honestly assess existing processes, technology, and skills to identify gaps in your GRC capabilities.

Map Out Your Stakeholders: Involve leaders from IT, legal, finance, HR, and core business units to understand their specific priorities.

Define an Initial Scope: Select one high-impact, low-complexity area to start with, such as IT risk management, to score an early win.

Phase 2: How do you design your strategy and select platforms?

This phase focuses on defining your target operating model, choosing the right technology, and creating a detailed implementation plan. The technology you select will become the central nervous system for all GRC activities, so it must be scalable. DataLunix.com specializes in fit-gap analysis for platforms like ServiceNow, HaloITSM, and Freshservice to ensure your chosen tool aligns with your long-term goals.

Phase 3: How do you manage implementation and change?

This phase is about configuring your GRC platform, migrating data, and managing the human side of the transition. Effective change management is often the key differentiator between a successful GRC program and a failed one.

Take an Agile Approach: Implement in small, manageable chunks to minimize disruption and adapt as you learn.

Obsess Over Data Quality: Cleanse and standardize risk and compliance data before migration to ensure accurate reporting from day one.

Invest in Training and Enablement: Provide role-based, hands-on training to show users how the new system makes their jobs easier.

Phase 4: How do you optimize for continuous improvement?

GRC is an ongoing cycle of measurement, refinement, and expansion. As your business evolves, your GRC program must adapt. For a deeper dive into regional specifics, check out our guide on compliance and risk management in the GCC and Europe. Continuously monitor KPIs, such as the time to close audit findings, to prove value and identify areas for improvement.

FAQ

What does GRC mean in simple terms?

GRC, or governance, risk, and compliance, is a unified strategy that ensures a company's internal rules (governance) are designed to identify and manage threats (risk) while following all applicable laws and standards (compliance). It connects these three functions to work together seamlessly.

What are the real benefits of GRC?

A strong GRC program shifts your organization from a reactive to a proactive mindset, providing a clear, real-time view of business-wide risks for smarter decision-making. It also automates manual tasks, reduces audit costs, and builds trust with customers and regulators.

What are the first steps to start a GRC program?

Begin with an honest assessment of your current state to identify your biggest pain points, such as audit inefficiencies or a lack of risk visibility. Secure stakeholder buy-in by proposing a small pilot project that solves one high-impact problem to demonstrate value quickly.

How can you tell if your GRC program is working?

A successful GRC program delivers actionable insights, not just data. Key indicators include faster incident response times, fewer audit surprises, and more confident crisis decision-making, making resilience a natural part of your organizational culture.

For CIOs looking to transform their governance, risk, and compliance framework from a cost center into a strategic advantage, DataLunix.com offers the expertise to build an intelligent, automated GRC program. We integrate GRC directly into your enterprise platforms to drive business resilience and simplify regulatory adherence. Start your journey to GRC maturity with a discovery workshop. Learn more at https://www.datalunix.com.